If you had to guess which category of vehicles were the fastest growing segment in the auto industry, especially in North America, what would you say?

Evidently, in a recent study done by Scotiabank on the global auto industry, crossover utility vehicles (CUV) were the fastest growing segment in the industry, with year-over-year gains of 13% in January 2010. According to Scotiabank economist, Carlos Gomes, CUV sales in the United States totalled 2.3 million units in 2009, only marginally less than the industry-leading mid-size cars, and will become the largest segment in 2010. In Canada, year over year gains in crossover utility vehicles (CUV) sales increased by 19% and just like in the United States, Gomes expects CUV purchases in Canada to lead the way in 2010.

The chart below is a Google trend chart analyzing user search behavior for the terms ‘cars’ and ‘gas.’

With auto purchases in January posting a double-digit increase for the fourth consecutive month, led by more than a doubling in volumes in China, the world’s largest auto market, the outlook for car sales hasn’t been this good in a long time. The sales numbers in the United States also increased year-over-year for the fourth consecutive month, climbing to an annualized 10.8 million units, up from a full-year 2009 total of 10.4 million. In Canada, car & light truck purchases remained above a year ago for the second consecutive month, however, seasonally adjusted purchases softened to an annualized 1.45 million units in January, down from a full-year 2009 total of 1.46 million, and an average of 1.55 million during the July to October period. Nevertheless, for Canada, Gomes expects “full-year 2010 volumes to increase to 1.53 million units, up from a decade-low of 1.46 million in 2009.”

While the statistics painted above may appear bullish, Gomes is quick to caution investors that:

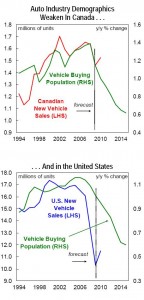

The global economy and auto sector are in the early stages of a cyclical recovery which will lift car and light truck sales in Canada and the United States above 13.0 million units in 2010, up from 11.9 million last year. However, unfavourable demographics, including the retirement of the baby boom generation, will dampen vehicle demand over the coming decades, leaving the industry increasingly dependent on replacement demand. While Generation Y will also become increasingly more important for the auto industry, growth in the vehicle buying population is set to moderate to the slowest pace in more than fifty years.

Gomes is concerned that the aging baby boomer population and their proximity to retirement age is increasing by nearly 5% annually while the number of young drivers in the 16 to 29 year age bracket is increasing at the slowest pace since the mid-1990s. Statistics show that many in the 16 to 29 year age bracket are postponing procuring their drivers licenses. U.S. data confirms that only 46% of the 16-to-19 year old teenage population has a driver’s license. This represents a sharp fall-off from over the past twenty years, when 64% of the 16 to 19 year old population had a driver’s license. Furthermore, only 72% of the population under 30 years of age in the United States currently has a license, compared with nearly 84% in 1998, and roughly 90% when their parents were the same age. This trend is comparable in Canada. In Ontario, which accounts for nearly 40% of the Canadian population, only 75% of the eligible driving age population between 16 and 29 years of age has a license.

The discrepancy between the growing number of retirees and the and the reduced number of young drivers is bound to manifest itself by way of reduced growth in the North American vehicle buying population to 0.6% per annum in Canada over the coming decade and only marginally higher in the United States. This is a marked departure from the average annual growth in the driving age population of 1.4% over the past fifty years. Gomes expects this slump to remain in place through 2030.

The report points to 2013 as being a pivotal year when the number of North Americans that are 60 years or older surpasses the potential young vehicle buying population, i.e. 16-to-29 year olds.

Ending on a slightly positive note, Gomes adds that:

The median age of the U.S. vehicle fleet is a record 9.4 years, with nearly half of the 250 million cars & trucks on the road at least 10 years old. Historically, nearly 6% of the U.S. fleet is replaced each year, with an additional 3 million units coming from new buyers. Vehicle scrappage is even more important in Canada, with an average of 7% of the fleet replaced each year. Scrappage slumped to less than 6% across Canada in 2009, but is set to rise over the coming year, helping counter the negative emerging demographic trends.

How has your perception of the auto sector, as investors, changed, if at all, after reading this report?