“Gold Is the New Tupperware, And You’re Invited to the Party.” This headline appeared in the December 18th, 2009 edition of the Wall Street Journal (click here to get 80% off a subscription to the Wall Street Journal). Suddently, it seems everybody is talking about gold. Does this world-wide interest in the yellow metal indicate a top?

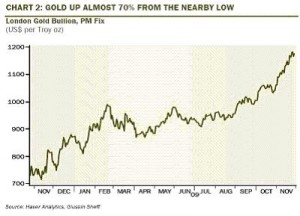

Vince Veneziana of “The Business Insider” recently interviewed David Rosenberg of Gluskin Sheff in Toronto. Rosenberg thinks gold could move to $2623 US. However, with gold’s stellar performance during the last few months of 2009, it is ready for a correction. Rosenberg feels it could have as much as a 20% pullback to its 200 day moving average or $970 and “no fundamental trendline would be broken” (as at 12/01/09). Commenting in Business Week, dated December 14th, 2009, Jordan Kotick, a technical analyst at Barclays Capital agrees that gold should move higher. He targets $1300 by March of this year and $1500 by 2011.

Much of the long term enthusiasm for gold is based on the increasing appetite of the growing middle classes in such places as China, India and Brazil. Rosenberg notes that the China Gold Association claims a 14% increase in domestic gold demand in 2009 over 2008. However, there may be bigger buyers waiting in the wings. In October of last year the Reserve Bank of India purchased 200 metric tones of gold. While that is not a particularly large number, the action in itself, is very significant. What would happen if China decides to unload some of its dollars to buy gold? This is why Rosenberg is so bullish.

There are some influential people in the US who are advocating a return to the gold standard. In his book “End the Fed”, Congressman Ron Paul advocates just that. He feels the Fed’s attempts to manage business cycles have back fired.

At the same time it is difficult to imagine any central bank selling gold reserves as Great Britain did between July 1999 and March 2002. Gordon Brown, at that time Chancellor of the Exchequer, authorized the sale at a price about one third of today’s price.

Another argument in favour of higher gold prices is of course, inflation . Money supply, by whichever measure you choose has increased dramatically over the past twenty years. Except for the last five or six years, the gold price has been range bound. So money supply growth and presumably its consequent price inflation are not well correlated. Other factors must come into play. And as those of us who have seen many market gyrations, it is rarely the same events that drive markets over a period of years. This latest price increase in gold very likely has a new driver, the transfer of wealth from the developed to the less developed world.