Diana Shipping Inc. is a shipping company of Greek origin quoted in the New York Stock Exchange. It is a global provider of shipping transportation services, and specializes in transporting dry bulk cargo such as iron ore, coal, grain and other materials. As of 1st March 2010 DSX had a fleet of fourteen Panamax vessels and eight Capesize vessels with a collective carrying capacity of 2.4 million dead weight tonnage (‘dwt’ – measure of weight a ship is carrying or can carry safely).

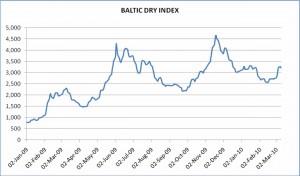

The Baltic Dry Index is the main indicator of the health of the dry bulk shipping market. The following chart illustrates the performances of Diana Shipping and its competitor Eagle Bulk’s stock with that of the Baltic Dry Index.

Source: Capital Link Shipping

As the above chart demonstrates the share price of bulk carriers and the Baltic Index move in tandem.

Due to the economic recession; DSX’s time charter revenue in 2009 was approximately 30% less compared to the same period in 2008. Net income for the year ended 31st December 2009 was USD 121.5m compared to a net income of USD 221.7m in 2008.

Source: Baltic Dry Index/Diana Shipping

Market fundamentals

As the above chart indicates shipping costs that rose in mid 2009 on expectations of an economic recovery have dipped in late 2009 and early 2010 on expectations of a fleet expansion. As ships take about three years to build, the ships ordered at the market peak in 2007 are likely to delivered this year.

International trade is the demand driver for shipping capacity. The Round Table of International Shipping Associations estimates that ships carry about 90% of world trade. The World Bank predicts a 4.3% gain in trade volumes this year and 6.2% in 2011.

China’s Cosco Holdings, the world’s largest dry bulk vessel operator anticipates shipping rates to jump by as much as 54% in 2010 compared to 2009. The demand is expected to come from China. China is expected to grow at a rate of 9.5% in 2010 (Bloomberg). The dry bulk shipping market is highly dependent on China’s imports of commodities such as iron ore to absorb capacity. However, China’s General Administration of Customs reported that the country’s iron ore imports declined by 25% in January, from the previous month. The People’s Bank of China also made moves in January to tighten monetary control in an attempt to prevent the economy from overheating. As it stands now if the Chinese economy collapses so would the bulk shipping market.

Fleet expansion

Being a shipping company it is important that a company minimizes the idle days and increase fleet utilization. It is also important to have capacity at the correct time. Therefore an order book that tallies with GDP growth is a good indication. DSX is pursuing a strategy of expanding its fleet through purchases in the next 24 months. The company purchased MV Melite in December 2009 and New York is under construction and is due for delivery later this year. Compared to DSX Eagle Bulk expects the delivery of 7 ships in 2010 and Excel Maritime 6.

Fleet age

Lower the fleets age higher the price that can be commanded. It also minimizes operational costs and non trading days. With a weighted average age of 4.7 years DXS has a relatively young fleet compared to its competitors; Eagle Bulk ( 6 years), Genco Shipping (6.42 years), Excel Maritime (12.9 years) and Star Bulk Carriers (10.2 years).

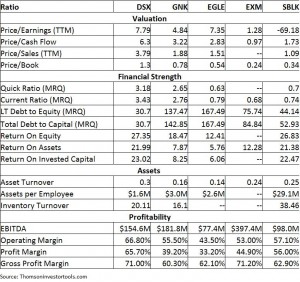

DSX’s trading at a higher Price to Book Value, Price to Earnings, Price to Cash Flow and Price to Sales Ratio than its peers.

However, it’s short term liquidity measured by the Quick Ratio and Current Ratio are better than the competitors. DSX’s debt burden is at a healthy level and is lower than the peers as measured by the Long Term Debt to Equity and Total Debt to Capital. The company also has a higher Return on Equity, Return on Assets and Return on Invested Capital than the competition. As a result DSX appears to be the most financially healthy of the five companies.

DSX higher Asset Turnover Ratio indicates it’s making more efficient use of its assets than the competitors. Though the company does not have the highest Inventory Turnover Ratio it is at a healthy rate. The only ratio it’s lagging behind others is the Assets to Employee Ratio.

DSX also has better profitability figures than the peers as measured by the Operating Margin, Profit Margin and Gross Profit Margin.

Given the capital intensive and price taking nature of the industry Net Asset Value is the best valuation measure for a dry bulk shipping company. However, in the absence of such information we could use the P/BV as a proxy. At 1.3 times DSX is trading at premium to its competitors. Nevertheless, its sound fundamentals, financial strength, liquidity, efficiency and profitability seem to justify the higher valuation.

Has this post provided you with any value? If so, please take a moment to share it via Facebook, Twitter or StumbleUpon. If you derive no value from this post, let me know how I can make improvements in the comment section below.