Update: This post was included in the Carnival of Personal Finance

Predicting a US$1700 - $2000 gold price in 2011, Nick Barisheff of Bullion Management Group urges investors to acquire unencumbered physical bullion with no financial intermediaries or counter-party risk, saying “owning gold, silver, and platinum bars is like having a real fire extinguisher instead of a paper picture of a fire extinguisher.”

We are very excited to present our interview with Nick Barisheff on gold, bonds, fiat currencies, economics, investing and more. Enjoy.

Note: This interview was conducted on November 23, 2010.

Biography: Nick Barisheff has focused on the world of precious metals and the advantages of investing in gold, silver, and platinum bullion for the past decade. As president and CEO of Bullion Management Group Inc. (BMG), a precious metals investment company, he uses his understanding of the precious metals markets to develop investment strategies, products and services for clients looking to integrate bullion into their portfolios.

In 2002, he launched BMG and BMG BullionFund, Canada’s only RSP eligible open-end mutual fund trust that invests directly in gold, silver and platinum bullion. Recently BMG launched BMG Gold BullionFund and BMG BullionBars. Mr. Barisheff specifically designed all BMG products to meet the three fundamental attributes of owning bullion: liquidity, no counterparty risk and independent of management skills.

Q: Can you compare gold and bonds as asset classes based on a riskiness and volatility?

A: The important thing from a riskiness point of view, bonds have several levels of risk that don’t exist in bullion at all, one of which is default risk. So although people think that bonds are safe, I would think that the investors in General Motors bonds, for example, wouldn’t agree with that analysis.

So investors should understand that gold it will never go to zero while financial assets have in the past and will in the future go to zero. In addition, the default risks associated with corporate bonds is now being manifested in sovereign bonds and that’s likely to happen across the board.

The second risk that you’ve got in bonds is credit rating downgrades. When the credit rating of a bond is downgraded, investors react by selling the bond which in turn drives the price of the bond down leading to a loss of principle. So they’re risky in that point of view also.

The ultimate risk is the fact that if you take true inflation into account, then bonds like they were at different times are essentially like certificates of confiscation, where they’re losing money day in and day out. Today the real rate of inflation is close to 9% and if you’re holding a 4% bond it’s a guaranteed loss of 5% a year. So all of those risk factors don’t exist in owning bullion.

Q: Is there a way to apply a fair value estimate to the price of gold? If so, what is it and if not, how can a retail investor be reasonably sure that the price they are paying to buy or sell gold is not vastly over or under priced relative to fair value (assuming that gold trades on more than just supply and demand)?

A: First of all it’s no different than if you had a stack of $100 bills sitting on your desk - how would you value them? Their value is based on whatever people believe they are whereas with gold you at least have some intrinsic value that’s based on the difficulty of finding, mining and producing it. In comparison with paper currencies right now it’s just a matter of typing in some numbers in a keyboard and voila, you have supposedly a currency that will have some level of purchasing power so it’s entirely faith based. Whereas gold’s intrinsic value at the bare minimum is dependent on the fact that it’s rare, it’s hard to find, it’s hard to dig up and so on. Right now, I think that one of the latest numbers I’ve heard that the cost of gold production is now approaching something like $900 an ounce in the middle of the road mines. So that’s one way to value it but just as you value currencies, how do you arrive at, how do you compare the value of a Swiss Franc versus a U.S. Dollar, they’re just pieces of paper with ink on them. So it’s a perceived value against the other alternatives when it comes to valuing it as money and that’s really the dilemma that many people confuse gold with being an industrial commodity when it’s actually money. However people should be cognizant of the fact that gold is traded on currency desks not commodity desks (at financial institutions) so it’s competing with currencies that have basically no value at all other than what people believe they are worth and as soon as people have a loss of faith, they become worthless.

Q: Gold is also touted as a hedge against the U.S. Dollar. Daily obituaries are posted by the financial media and trading sentiment is extremely negative towards the greenback. It would appear that nearly everyone is bearish on the greenback. Wasn’t this the same situation that gold was in during the late 1990s when the Financial Times, published an article, entitled the ‘Death of Gold? Very few people at that time had the foresight to buy gold and is there a chance that those same people or perhaps an entirely new group is doing the same with the U.S. Dollar at this moment? Is there a possibility/chance that 10 years down the road that we’ll see the value of the U.S. Dollar at significantly greater levels from today and price of gold at significantly lower levels?

A: It’s highly unlikely. Throughout all of history there isn’t one example of a fiat currency not ending up worthless, not once throughout all of history. During the course of its existence a fiat currency ends up in a hyperinflationary environment followed by deflationary collapse and then you start all over again. So the issue is that we’re heading into a situation where, I think, plus or minus 5-10 years, possibly sooner, that the U.S. Dollar will no longer be the world’s reserve currency and may not even exist in its present form.

Q: So what will be the alternative?

A: The alternative is always to create a currency that has some limit on its quantity. When you look at when the Euro was first established it was to have a minimum 15% backing in gold and it kind of drifted away from that policy. So the issue is that without controls on the quantity of the currency, the politicians, the kings, the empires as they’ve done throughout all of history will eventually debase the currency into oblivion by creating too much of it. Furthermore, we have an even greater problem right now. It’s not just that the treasury department is printing money but the treasury department is actually issuing treasury bills and bonds and the Federal Reserve is printing the money. So the money is being created through debt, which is many times worse than just printing the money. If you just printed the money then there would be no interest to pay.

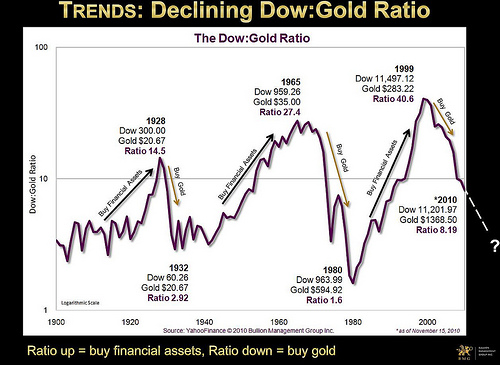

Q: Can you get into a bit more detail about the Dow:Gold ratio in terms of its implications, past, present and perhaps future performance?

A: On the one hand, if you had followed the DOW/Gold ratio for the last probably 100 years, you wouldn’t have had to have made any other investing decisions. When the ratio is going up, you should have had an overweight position in financial assets in your portfolio. When it’s going down, you should have had an overweight in tangible assets and particularly precious metals. So if you had simply followed the Dow/Gold ratio and didn’t pick any obvious losers you would have done extremely well.

However that doesn’t typically happen because the cycles (as depicted in the chart above) are very long. They’re almost generational and continue for plus or minus 20 years. So when people are in one part of the cycle, they get so entrenched in their mindset that they can’t readily make the switch. The same thing happened when the DOW/Gold ratio peaked in 1980. At the time people were not interested in stocks and the majority got interested in stocks in the late 1990’s. As a consequence, many missed most of the bull market because their mindset was entrenched in the knowledge that stocks went nowhere stemming from the flat returns of equities from 1968-1982, without even taking into account inflation.

So while the Dow/Gold ratio is a very good indicator of what assets investors should (in a broad sense) be overweight or underweight, the signal calls on people to make a very difficult switch in mindset, which is extremely hard to implement. This is simply a result of human nature. People are complacent and they don’t like change. However, in investing you need to regularly re-evaluate the themes and situations with an open mind and once you’ve investigated and drawn some conclusions then you make changes. The DOW/Gold ratio is a good indicator of when those changes need to be made – in dramatic fashion. However, not only is the signal not adhered but as a consequence the asset allocation changes are not being made either. The majority of investors today after a ten year bull market in gold and precious metals have zero allocation to gold. To me, it couldn’t have been more obvious to have shifted your allocations in 2000.

Q: The chart (above) would imply that the bull market in gold would last another 10 or another 12 years - yes?

A: From that perspective, it’s looking like we could go to a one to one DOW/Gold ratio. The question is at what number will gold and the DOW get to that 1:1 level – 2000 or 20000, it could be either. So that’s one outcome. But the other outcome is that if we get into a situation where the currency (U.S. Dollar) completely declines into oblivion then the ratio no longer works in that sense.

Q: Can you detail 3 economic trends that you are seeing right now? What are the implications for these trends?

A: The 3 trends I am about to talk about are the ones that are driving the currency crisis and forcing governments into printing money.

The first trend we can talk about is the aging baby boomers. The baby boomer generation has been responsible for the economic conditions as they’ve progressed through society for the past 50 years. As they were getting married, buying houses, having kids and started investing, they drove the economy. As these boomers approach retirement, from an economic point of view their spending habits decline as they already own all the stuff they need. Their children have likely finished school and are working. They’ve likely paid of the mortgage on their homes and they’ve already bought all the stuff that will furnish that home. So the consumer spending part of what has driven at the economy for the last number of years starts dropping. Then as they retire and ease into the retired lifestyle, that consumer spending drops even further. Moreover, retirees start withdrawing money from the system in terms of pensions, social security and Medicare and all the rest of it. They slowly become a cost to society.

In particular, in the U.S. the social security is like a giant hole of something to the order of over a hundred trillion. Money that isn’t there is being spent. Part of that is the Medicare obligations, which are going to be huge because of the health conditions of the aging baby boomers. A huge segment of the baby boomer population already has all kinds of medical issues which are only going to get worse as time goes on. So with that you are going to have a reduction in GDP, a reduction in government revenues, an increase in government outlays, which will force the government to have to borrow more money and that will at one point become more and more an issue of printing the money because they won’t be able to sell the debt to foreigners which is what they’ve been doing. That’s not just an American situation. We’ve got the same problem in Japan and Russia and many of the countries in Europe. So, that’s one of the issues that’s going to cause the government to debase their currency by printing more which will increase the price of gold.

The second issue is the issue of peak oil. Many studies have been done on this subject and while it’s not discussed in the mainstream media, the issue is that we’ve already peaked in terms of conventional oil and within the next few years we are going to peak in oil generally. Peak oil does not mean we are out of oil it just means we’re at peak production. So as production declines and demand increases (from the emerging economies), we’re obviously going to have an increase in the price of oil which will lead to an increase in the price of everything. Apart from printing money, oil is the only thing that can cause massive inflation across the board. So as we get into those conditions, there will be a global decline in GDP. The importing countries will face an increase in trade deficits that will have to be financed, which results in more money being printed. In each of these cases we are also generating higher and higher levels of unemployment that is basically systemic unemployment.

Q: What are you thoughts on the amount/allocation of gold people should hold in their portfolios?

A: A starting point is to have a diversified balance portfolio. According to an Ibbotson study, you need a 7% allocation to gold in a mainly conservative portfolio and a 16%-17% allocation in an aggressive portfolio. That’s simply to have a balanced diversified portfolio or what may also be known as strategic allocation. From a tactical allocation standpoint, Wainwright Economics looks to gold as being a leading indicator of future inflation. When you have high inflation, their conclusion is that you need 17% in a bond portfolio, and 40% in an equity portfolio just to break even against inflation. Most people are surprised at 40% in an equity portfolio but if we consider the 1970s when the DOW was flat between 1968 and 1982, inflation hit 15% and the price of gold rose 2,300%, you can see how 40% would have kept you ahead of inflation in the 70s.

We’re actually heading into a condition much worse than the 70s from the point of view of the global currency crisis and from my point of view I don’t see anything worth investing in. There’s no rule that says I have to be invested so when I hold gold I’m not invested, that’s just money. So at this point in time I’d rather just sit on my money and wait on an investment opportunity than to have a diversified portfolio.

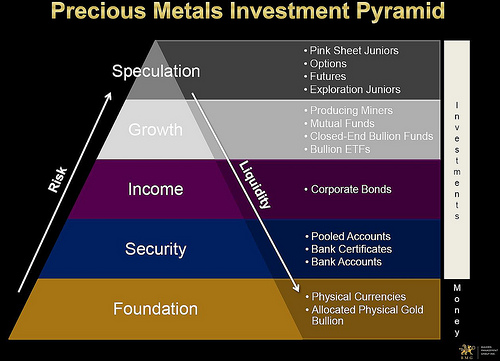

Q: You sent over a very interesting chart called the ‘Precious Metals Investment Pyramid’ - can you talk a little about what the chart depicts?

A: As you go up the pyramid you have increasing risk and as you go down the pyramid you have increasing liquidity. So the foundation of the pyramid needs to be physical bullion that you own outright. As you go up the pyramid you get into more or less proxies of bullion in one form or another that are both more risky and less liquid. So, that’s kind of the general thing.

If you really study the situation now, the issue is that we’re heading into a financial and currency crisis that is probably unprecedented in history. Looking at the performance of the DOW on a year to date basis, it’s probably up something like 8%, I don’t have the charts in front of me but in gold terms you’ve lost 15%. My point is that during times of crisis and upheaval, you should just hold onto your real money, which is gold. Invest in the future when the time is right rather than be invested now and risk losing a substantial part of your money.

Q: Having covered a lot of ground on gold itself, let’s turn to BMG and its products. Why would investors want to purchase the BMG Bullion Funds? When it comes to fees, the BMG Funds have an MER of 2.25% for the Class A units. Similar products like the Sprott Gold Bullion Fund and even the Mackenzie Universal Gold Bullion Class A Series have MER’s of 0.80% & 1.85% respectively. So why should investors pony up that extra bit in fees given the comparables?

A: We have two broad categories of products. We have securitized versions of bullion like the BMG Funds and then the actual ability to buy, what I consider investment grade bars of bullion. The bars of bullion (gold or silver) are primarily suitable for high net worth individuals that can buy individual bars because the cheapest is a 1,000 ounce silver bar which today would be just under $30,000. For smaller investors, institutions and hedge funds, that can’t typically buy the bars, we offer the securitized version of owning bullion. It’s my opinion that the securitized version, which is our funds, should not compromise the major attributes of bullion. The major attributes are first of all liquidity. Bullion is basically highly liquid in any country 24 hours a day, 7 days a week. So in order to achieve that, you don’t want an exchange traded fund who’s liquidity will be based on the trading volume of that fund. By being an open-ended mutual fund trust, where we buy and sell bullion into the bullion markets, the liquidity of our fund, is the same as bullion itself.

Secondly, when you buy a securitized version of bullion, you want to own bullion. So we only buy delivery bars, take possession of them into the funds’ allocated accounts and we track all the ownership. So we don’t have any proxies or derivatives of bullion in the fund. So there’s no certs, there’s no futures contracts, there’s no mining stocks - all of those are proxies and derivatives of bullion, we have actual bullion.

Thirdly, when you are investing in bullion, you don’t want to have an investment that’s largely dependent on the trading skills of the portfolio manager. We have a fixed investment policy where as money comes into the fund we simply buy either gold silver platinum in the one fund, or gold in the other fund. We don’t market time, we don’t hedge, we don’t lease, we don’t re-balance and we don’t leverage because any of those things - which may drive some short-term benefits also introduce the risk of the portfolio manager making a mistake. That’s happened before, in fact it happened during in the financial crisis of 2008 where some of the smartest guys in the business made really big mistakes. So you don’t want that happening to your bullion investment. So that’s the major difference with us is we don’t compromise the attributes of bullion in any way.

One of your questions had to do with our MER being slightly higher than some of our competitors. Well that’s because we’re dealing in real bullion. I can have the MER be a lot lower if I dealt with proxies, did some hedging and that kind of thing but then the investors run the risk of something going wrong. That’s not what you want in your bullion investment.

Thank You, Mr. Barisheff!